- Overview

- Specialization Structure

- Accreditations

- Faculty

- Admission

-

Duration

4 Years

-

Classes

Weekday Weekend

-

Fees

Tuition (One Semester) ……… Approx. 21,000 AED

One academic year is two semesters

Admission (One Time) ……… 3,150 AED

About Specialization

Join the elite league of financial wizards with our Bachelor of Business Administration in Finance program. Delve into the captivating world of investments, risk management and financial planning. Acquire the skills to analyze market trends, make sound investment decisions, and drive organizational success through effective financial management. Upon graduation, you will be armed with a versatile set of skills that will enable you to pursue a lucrative career in banking, investment, corporate finance and more. Unleash your potential and embrace a future brimming with financial prosperity.

Bachelor of Business Administration - Program Goals

- Provide quality and accredited undergraduate business degree programs in the areas of business studies and practices.

- Offer preferred and career-oriented undergraduate business curriculum with specialized coursework and practical application to meet national and international job market demand.

- Prepare students to become professionals in their chosen fields with the skills needed to meet the demands of a dynamic business environment regionally and internationally.

- Develop critical thinking and reasoning skills to evaluate information, solve problems, and make sound decisions.

Bachelor of Business Administration - Program Learning Outcomes

- Acquire knowledge about the fundamental concepts, principles and theories in the specialization.

- Develop interpersonal and leadership skills relevant to their career paths.

- Analyze and interpret specialized data and information to make rational business decisions.

- Apply innovative and advanced approaches to evaluate national and international business environment.

- Demonstrate practical skills of various business disciplines.

Preparatory Courses

Before enrolling in the Bachelor of Business Administration program, students must sit the placement test related to this program. Failure to successfully pass the placement test, the student is required to enroll in the following courses:

#

1

2

3

Course Code

CIT 90

MAT 90

ENG 99

Courses

Computer Preparatory

Mathematics Preparatory

Academic Writing (*)

Credit Hours

0

0

0

Exemption Condition

Passing the Placement Test

Passing the Placement Test

Passing the Placement Test

Program Structure

Course Category

General Education Courses

Core Courses

Specialization Courses

Free Elective

Total

Total Number of Courses

11

18

11

3

43

Total Number of Credit Hours

33

51

33

9

126 Credit Hours

- General Education Courses

- Core Courses

- Specialization Courses

- Free Electives

A: University Core Requirements

The student selects 6 credit hours (2 courses) from the list below:

The purpose of this course is to facilitate the process of transition into the new academic and cultural environment for the new students enrolled in the AUE. Furthermore, it aims to promote their confidence so that they could succeed and meet their academic requirements. The course assimilates academic content with interactive in-class activities to ensure understanding of curricular options and begin to develop a future career plan through self-reflection.

B: Languages and Communication Studies

The student selects 9 credit hours (3 courses) from the list below:

Students must take all of the following courses:

Students must take one of the following Arabic Language courses:

C: The Natural sciences or Mathematics

The student selects 6 credit hours (2 courses) from the list below:

D: The Social or Behavioral Sciences

The student selects 3 credit hours (1 course) from the list below:

E: The Humanities or Arts

The student selects 3 credit hours (1 course) from the list below:

F: Islamic Studies

The student selects 3 credit hours (1 course) from the list below:

G: UAE Studies

The student selects 3 credit hours (1 course) from the list below:

Organizational behavior studies the influence of individuals, groups, and work culture on behavior within organizations; its chief goal is to improve an organization’s effectiveness. This course introduces students to the core concepts of organizational behavior including attitudes, emotions, and moods; communication; conflict and negotiation; diversity; group behavior and work teams; individual decision making; leadership and power; motivation; organization culture and structure; organizational change; and personality and values.

The course aims to interpret the basic theories and the practices in production and operations management. The course equips the students with the necessary skills, and utilization of tools and techniques for effective and efficient management of operations. It further provides skills to the students for better decision-making and problem solving in any industrial scenario.

This course familiarizes students with the concept of the rule of law as a mechanism for ordering people’s (and companies’) behavior, and for providing predictability and certainty in planning business transactions. Students will consider the legal issues inherent in business, considered from the standpoint of various business roles such as business owner, corporate officer, board member, shareholder, partner, officer, manager, employer and employee, customer and client. It aims to have students anticipate potential legal issues in business transactions so that they can plan to avoid legal problems and, when they do occur, formulate solutions.

This course introduces the core quantitative methods that are prerequisites for adequate business analytics and decision-making in business. It focuses on all three business analytics models, including descriptive, predictive, and prescriptive models. The knowledge taken from this course equips students with tools for assessing various business problems and making decisions based on quantitative business analytics. The overall objective of this course is to provide students with a sound conceptual understanding of management science models and their role in solving business problems.

The course aims to interpret the basic theories and the practices of sustainability in business. It equips the students with insight into how new technologies can be used to solve sustainability issues. The course further creates solutions for effective and efficient management of operations by providing an understanding of how to navigate the tensions between pursuing sustainability initiatives and optimizing business performance.

This course captures the complexity of current business environment and offers contemporary concepts and skills which enables the students to design cutting-edge strategy through skills building exercises. Furthermore, it benefits attendees to gain necessary knowledge to manage consistent higher organizational performance by reading, analyzing and designing suitable working environment. Different models and tools in the course are practically applicable to find out strengths, weakness of the organizations, this analysis finally helps students to design the effective strategies and strategic plan for the business.

This course introduces students with the techniques used by cost accountants in the organizations. Approaches include cost control and product costing which assists in managerial decision making. Topics include cost accounting concepts, procedures, methods and techniques used for personnel, production, factory overhead costs, inventory, work-in- progress, costs allocation of service department, job orders, process, joint and by-product costing, cost control, and standard costing.

This finance course advances the preliminary concepts covered at the introductory level and applies them to fundamental activities of financing, investing and valuation of corporations. This involves allocation and acquisition of resources, leveraging the capital structure of the firms and analysis of corporate transactions. This course aims at determining the best methodology to achieve wealth maximization for shareholders. It acquaints the students with valuation of financial assets, financial investing decisions, capital budgeting, and dividend payout policies, with emphasis on both short-term and long-term managerial policies.

The aims of the course are to introduce the students to the main role of the central banks, banking sector and the main monetary policies. In addition, the course enables them to learn about the major financial markets and their regulations. On the other hand, the course targets toward teaching the students about the current monetary practices linking them to the field of banking industry. Money is the blood stream of any economy; this course introduces the students into the basic concepts of banking and how changes in the money supply can affect any economy. It covers topics including barter, the evolution of money, the gold system, trade, investments and currencies. The accounting treatment of the financial banking products is also discussed to acquaint students with the technical knowledge of banking and reserve systems. Monetary policy

The course enriches the knowledge of finance students about the difference between the conventional and Islamic banking financial system. The goal of the course is to equip students with the knowledge of banking activities that are consistent with the Shariah principles and its application as well as developing moral and ethical financial values for implementation.

This course provides important insights of basic investment concepts, strategies, and theories in the contemporary financial environment. It introduces students to various investing strategies and focuses on the application and the implementation of these strategies. Topics covered include the determinants of stock prices, dividend growth models, fund management and investment strategic policy. The course introduces students to the analytical approach of how investors identify critical success factors, and explain how effective investors and fund managers plan and implement strategies related to portfolio management and international investment.

This course aims at introducing concepts of security analysis and designing strategies for creating stock portfolios. It covers the market structure theories, risk mechanisms and analysis of different valuation approaches for sound investing decisions. Students will be introduced to hedge management strategies and the emerging field of behavioral finance will be discussed throughout the course.

Finance gurus and economists alike have embraced the evolution in finance, the cryptocurrency financial system and related financial innovative products. This course enables the students to distinguish between a crypto driven system and the traditional financial system. As the transitionary phase is underway, it paves ways for countless opportunities but also calls for emerging threats. This course compares the Financial Intermediation in Cryptocurrency Markets, its Regulation and identifies gaps to obtain solutions. Topics include; Global Financial Institutions, Financial Inclusion and Micro Finance Institutions, Big Data, Smart Data and Data Technology.

This course advances students into the international aspects of international financial management and being effective in the global financial market. It involves theories related to foreign currencies, hedging techniques, swaps, interest rates and global political risk. Students will be exposed to the foreign market dynamics in order to analyze the multinational firms within the global financial market arena; and, they will be able to assess the international environment, recognize opportunities, implement strategies, assess exposure to risk and manage the financial risk.

The world has changed the way we use the financial products and services. Financial technology or FinTech has created a ripple effect in the economy, thus generating both opportunities and threats in the traditional economy while transitioning its way to the future. Banks, Insurers, Financial institutions and start- ups all have become avid users of financial technology, popularly known as fintech. Students will gain understanding of how the fintech ecosystem is gaining a worldwide acceptance due to lower costs and increased completion and at the same time ensuring a smooth payment mechanism. Global fintech investment grew by 75% in 2015 thus clearly directing the future of the ecosystem and the Future of Digital Advice; the Robo Advisors.

An internship experience is an effective means to bridge the gap between theory and practice. The students enrolled in the Bachelor of Business Administration program require to take this mandatory course as part of their specialization requirement. As this specialization deals with the practical side of the business, students can explore their career interests. This course is aimed at making students market ready and to ensure that the knowledge acquired in the classroom setting can be applied to the external environment. The internship must occur in a workplace underlying practical fintech activities and within the framework of Finance.

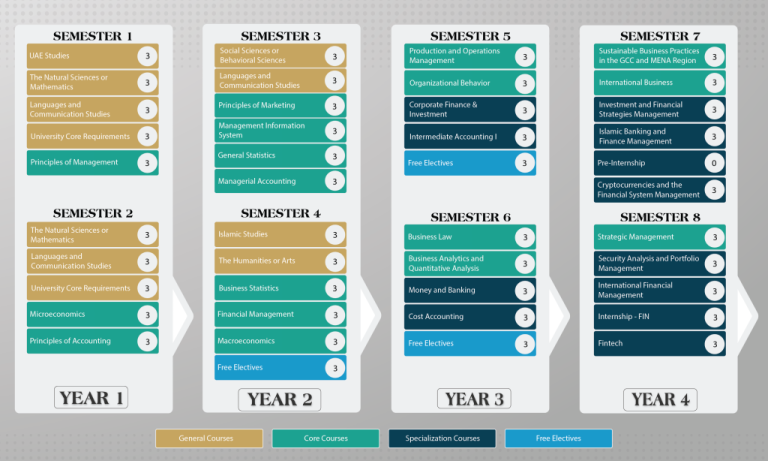

Recommended Study Plan

Accreditations

The American University in the Emirates is licensed by the UAE Ministry of Education – Commission for Academic Accreditation | caa.ae

The College of Business Administration and its degree programs (Bachelor of Business Administration, Master of Business Administration, Master of Sport Management) at the American University in the Emirates are accredited by The Association to Advance Collegiate Schools of Business (AACSB) as of 2022. Furthermore, The American University in the Emirates College of Business Administration is a proud member of AACSB.

Prof. Asma Salman

Professor / Dean

Prof. Robert P. Karaszewski

Professor / Program Director - Master of Business Administration

Dr. Sung IL Hong

Assistant Professor / Program Director - Master of Sports Management

Dr. Azzam Hannon

Associate Professor / Department Chair of Accounting and Finance

Undergraduate Requirements

For undergraduate degree completion, graduate students must satisfy the following requirements:

- Earn a minimum CGPA of 2.00 on a scale of 4.00.

- Successfully complete all courses as described in the study plan.

- The Degree Completion requirements must be met within the timeframe of the program.

- Transfer students must successfully earn a minimum of 50% of the course credits for the program at AUE.

Joining the Program

- Fall Semester

-

September

-

Spring Semester

- January

- Summer Semester

- May