- Overview

- Specialization Structure

- Accreditations

- Faculty

- Admission

-

Duration

4 Years

-

Classes

Weekday Morning Weekday Evening

-

Fees

Tuition (One Semester) ……… Approx. 21,000 AED

One academic year is two semesters

Admission (One Time) ……… 3,150 AED

About Specialization

Unlock the realm of numbers and numbers-backed success with our Bachelor of Business Administration in Accounting. Discover the language of business and become a master of financial analysis, auditing and taxation. Our highly-acclaimed faculty will guide you through the intricacies of accounting principles and best practices, preparing you for a career where numbers are king. With a solid foundation in accounting, you can look forward to a career with any top-tier firm, corporation or financial institution. Prepare to embark on a rewarding journey filled with career growth, financial stability and endless opportunities.

Bachelor of Business Administration - Program Goals

- Provide quality and accredited undergraduate business degree programs in the areas of business studies and practices.

- Offer preferred and career-oriented undergraduate business curriculum with specialized coursework and practical application to meet national and international job market demand.

- Prepare students to become professionals in their chosen fields with the skills needed to meet the demands of a dynamic business environment regionally and internationally.

- Develop critical thinking and reasoning skills to evaluate information, solve problems, and make sound decisions.

Bachelor of Business Administration - Program Learning Outcomes

- Acquire knowledge about the fundamental concepts, principles and theories in the specialization.

- Develop interpersonal and leadership skills relevant to their career paths.

- Analyze and interpret specialized data and information to make rational business decisions.

- Apply innovative and advanced approaches to evaluate national and international business environment.

- Demonstrate practical skills of various business disciplines.

Preparatory Courses

Before enrolling in the Bachelor of Business Administration program, students must sit the placement test related to this program. Failure to successfully pass the placement test, the student is required to enroll in the following courses:

#

1

2

3

Course Code

CIT 90

MAT 90

ENG 99

Courses

Computer Preparatory

Mathematics Preparatory

Academic Writing (*)

Credit Hours

0

0

0

Exemption Condition

Passing the Placement Test

Passing the Placement Test

Passing the Placement Test

Program Structure

Course Category

General Education Courses

Core Courses

Specialization Courses

Free Electives

Total

Total Number of Courses

11

18

11

3

43 Courses

Total Number of Credit Hours

33

51

33

9

126 Credit Hours

- General Education Courses

- Core Courses

- Specialization Courses

- Free Electives

A: University Core Requirements

The student selects 6 credit hours (2 courses) from the list below:

B: Languages and Communication Studies

The student must select 9 credit hours (3 courses) from the list below.

Students must take all of the following courses:

Students must take one of the following Arabic Language courses:

C: The Natural sciences or Mathematics

The student must select 6 credit hours (2 courses) from the list below:

D: The Social or Behavioral Sciences

The student must select 3 credit hours (1 course) from the list below:

E: The Humanities or Arts

The student must select 3 credit hours (1 course) from the list below:

F: Islamic Studies

The student must select 3 credit hours (1 course) from the list below

G: UAE Studies

The student must select 3 credit hours (1 course) from the list below.

Organizational behavior studies the influence of individuals, groups, and work culture on behavior within organizations; its chief goal is to improve an organization’s effectiveness. This course introduces students to the core concepts of organizational behavior including attitudes, emotions, and moods; communication; conflict and negotiation; diversity; group behavior and work teams; individual decision making; leadership and power; motivation; organization culture and structure; organizational change; and personality and values.

The course aims to interpret the basic theories and the practices in production and operations management. The course equips the students with the necessary skills, and utilization of tools and techniques for effective and efficient management of operations. It further provides skills to the students for better decision-making and problem solving in any industrial scenario.

This course familiarizes students with the concept of the rule of law as a mechanism for ordering people’s (and companies’) behavior, and for providing predictability and certainty in planning business transactions. Students will consider the legal issues inherent in business, considered from the standpoint of various business roles such as business owner, corporate officer, board member, shareholder, partner, officer, manager, employer and employee, customer and client. It aims to have students anticipate potential legal issues in business transactions so that they can plan to avoid legal problems and, when they do occur, formulate solutions.

This course introduces the core quantitative methods that are prerequisites for adequate business analytics and decision-making in business. It focuses on all three business analytics models, including descriptive, predictive, and prescriptive models. The knowledge taken from this course equips students with tools for assessing various business problems and making decisions based on quantitative business analytics. The overall objective of this course is to provide students with a sound conceptual understanding of management science models and their role in solving business problems.

The course aims to interpret the basic theories and the practices of sustainability in business. It equips the students with insight into how new technologies can be used to solve sustainability issues. The course further creates solutions for effective and efficient management of operations by providing an understanding of how to navigate the tensions between pursuing sustainability initiatives and optimizing business performance.

This course captures the complexity of current business environment and offers contemporary concepts and skills which enables the students to design cutting-edge strategy through skills building exercises. Furthermore, it benefits attendees to gain necessary knowledge to manage consistent higher organizational performance by reading, analyzing and designing suitable working environment. Different models and tools in the course are practically applicable to find out strengths, weakness of the organizations, this analysis finally helps students to design the effective strategies and strategic plan for the business.

Intermediate Accounting I is the first course in a two-course sequence with a focus on the continued study of the accounting and reporting processes within the framework of accounting theory. Main topics include in-depth analysis of IFRS (International Financial Reporting Standards), accounting theory, and requirements for publicly owned corporations. The course is targeted towards undergraduate accounting and finance specializations and focuses on the importance of preparing, analyzing, and communicating business information in ways that are relevant and useful to the end users of financial reports. This course builds upon the theories, principles and practices surveyed in ACC 100 (Principles of Accounting) and incorporates the examination of current real-world issues in financial reporting and analysis.

Accounting objectives are ever changing. Students must know how to generate financial information for interested parties and to provide managers with useful information, “Accountants must act as well as think”. The course is a continuation of Intermediate Accounting I and focuses on financial reporting requirements for public corporations. Core elements of accounting and financial statements including determining shareholder equity and long-term liabilities, income and cash flow reporting, and income tax and inflation accounting will be examined in the context of International Financial Reporting Standards (IFRS).

This course introduces students with the techniques used by cost accountants in the organizations. Approaches include cost control and product costing which assists in managerial decision making. Topics include cost accounting concepts, procedures, methods and techniques used for personnel, production, factory overhead costs, inventory, work-in-progress, costs allocation of service department, job orders, process, joint and by-product costing, cost control, and standard costing.

This finance course advances the preliminary concepts covered at the introductory level and applies them to fundamental activities of financing, investing and valuation of corporations. This involves allocation and acquisition of resources, leveraging the capital structure of the firms and analysis of corporate transactions. This course aims at determining the best methodology to achieve wealth maximization for shareholders. It acquaints the students with valuation of financial assets, financial investing decisions, capital budgeting, and dividend payout policies, with emphasis on both short-term and long-term managerial policies.

This computerized Accounting course brings together two business areas of accounting and information technology. The traditional accounting functions are carried out technically with acquiring the contemporary accounting and finance skills within this course. The ever-changing business environment and technological advancements require a different knowledge skill set which is embodied in this course to help students achieve the dynamic business demands. This practically driven course is mostly taught in the accounting labs with the appropriate use of accounting software.

This course lays emphasis on the planning process including short-term plans, and the budgetary goals and objectives of management. It explains how adequate planning and budgeting can help with financial problem solving and foster growth in the long run. This course also explains control concepts and fundamentals; the preparation and presentations of the processes and how to analyze results and variances. This results in applying the practical techniques at various managerial levels within a business environment. Topics covered include, targets, direction, budgeting resource allocation, and control activities.

This course aims at introducing the basic concepts, standards and procedures necessary for carrying out an external audit. Emphasis is laid on the Audit of the Financial Statements, the resulting outcome and how to form an opinion based on ethical and legal aspects.

This accounting course advances students into partnership accounting and addresses businesses in the global market place. It introduces concepts of transfer of business ownerships, mergers and acquisitions and their accounting treatments, as well as understanding the different forms of partnership concerns which are fundamental in the Arab world. Students will be understanding the consolidation of financial statements in different currencies and more emphasis will be laid on the practical aspect of accounting.

It is necessary for accounting students to understand tax concepts and tax issues. This course is intended to determine the difference between financial and tax accounting, introduce students to taxes, objectives, characteristics and its importance to economic developments in different countries and in UAE as well. Additionally, the course provides an understanding of tax filing status, deductions, and taxable income computation. It also provides the students with the knowledge and skills needed to apply Value Added Tax (VAT) in practice, rules, and computations in different countries and UAE.

Moreover, this course will equip the students with principles & standards used for taxation systems. Upon completing this course, students are expected to use to tax issues treatments that is crucial for their career skills. Furthermore, covering in-depth both individual taxation and business taxation, is expected to enhance students with knowledge, and provides them with a strong foundation. Finally, the contents of this course are designed to provide students with technical and practical details needed in their work field.

This course is the last one in the Accounting specialization and requires students to have a sound knowledge of the accounting concepts. It aims to equip students with a global understanding of the accounting information relevant to both the internal and external users. Topics include all the relevant techniques and skills acquired in financial accounting and applying them in a foreign context.

An internship experience is an effective means to bridge the gap between theory and practice. The students enrolled in the Bachelor of Business Administration program require to take this mandatory course as part of their specialization requirement. As this specialization deals with the practical side of the business, students can explore their career interests. This course is aimed at making students market ready and to ensure that the knowledge acquired in the classroom setting can be applied to the external environment. The internship must occur in a workplace underlying practical accounting analytical activities and within the framework of Accounting.

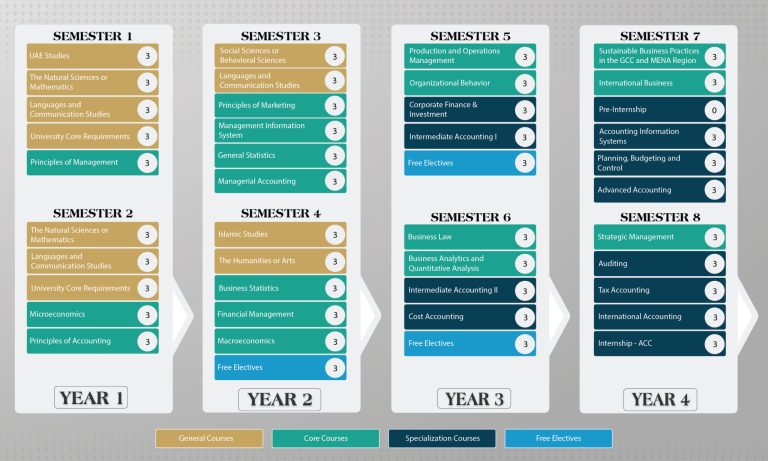

Recommended Study Plan

Accreditations

The American University in the Emirates is licensed by the UAE Ministry of Education – Commission for Academic Accreditation | caa.ae

The College of Business Administration and its degree programs (Bachelor of Business Administration, Master of Business Administration, Master of Sport Management) at the American University in the Emirates are accredited by The Association to Advance Collegiate Schools of Business (AACSB) as of 2022. Furthermore, The American University in the Emirates College of Business Administration is a proud member of AACSB.

Prof. Asma Salman

Professor / Dean

Prof. Robert P. Karaszewski

Professor / Program Director - Master of Business Administration

Dr. Sung IL Hong

Assistant Professor / Program Director - Master of Sports Management

Dr. Azzam Hannon

Associate Professor / Department Chair of Accounting and Finance

- For Admission Requirements for Freshman students (those who have just completed high school and have never attended an Institute of Higher Education before) click here

- For Admission Requirements for Transfer students (those who have studied at another higher education institution and would like to transfer their credits to AUE) click here

- For Admission Requirements for Visiting students (those who are currently enrolled in a different higher education institution and would like to take some courses at AUE as part of the study plan of their home university/college) click here

Joining the Program

- Fall Semester

-

September

-

Spring Semester

- January

- Summer Semester

- May